Introduction: The Surprising Cost Gap Tesla Owners Face

Tesla is a revolutionary car brand that combines cutting-edge technology with eco-friendly driving. It’s sleek, fast, and boasts impressive electric capabilities. Yet, there’s a stark reality that many Tesla owners face: Tesla insurance costs a lot more than for most other cars.

This price disparity surprises many Tesla owners, especially those who expect to save on insurance simply because they drive an electric vehicle. However, the reasons behind this price gap are more intricate than most realize. While you might think higher premiums are the cost of owning a luxury car, there are hidden factors that push Tesla insurance costs through the roof.

Most Tesla owners don’t fully understand these factors, and that leads to unnecessary overpaying. This blog aims to critically dissect why Tesla insurance is more expensive than insurance for other vehicles. We’ll also highlight some common misconceptions and provide actionable steps to help you reduce your Tesla insurance premiums without sacrificing coverage.

Timeline: How Tesla Insurance Costs Escalate

Understanding how Tesla insurance pricing escalates can help you identify where to make smart choices. Here’s a typical timeline that shows how Tesla owners often fall into the trap of overpaying:

- Purchase Day:

You’re excited about owning a Tesla and focus mostly on the car itself, leaving insurance costs to the side. - First Insurance Quote:

You get your first insurance quote, and it’s much higher than you expected compared to your previous car. This is the first shock. - Sticker Shock Response:

Rather than investigating why the premium is high, many owners accept the first quote they get, assuming it’s the best option. - Inertia Phase:

As your annual renewal comes up, premiums increase, but you continue paying without challenging the insurer. - Claim-Time Reality:

When it’s time to file a claim or pay for repairs, you realize just how much of your premium went towards covering expensive parts or tech repairs that could have been avoided. - Realization & Action:

After paying more than you should, you finally start asking questions about why Tesla insurance costs so much and how to lower it

Why Tesla Insurance Costs More: The Unspoken Reasons

Tesla owners often assume that high premiums are linked only to the car’s luxury status. While this is partly true, there are several hidden factors that make Tesla insurance more expensive than that of traditional cars. Let’s critically examine why Tesla insurance premiums are higher:

1. Repair Costs: Parts, Labor, and Technology

Tesla cars are equipped with advanced electric technology, including a high-performance battery and autonomous driving features. When accidents happen, repairing these high-tech components isn’t cheap. Traditional repair shops often can’t service these specialized parts, so Tesla-approved facilities are required, and they charge much more.

- Battery and motor repairs: Replacing or repairing Tesla’s battery packs or electric motors is a costly affair. Insurance companies factor these high repair costs into their premiums.

- Specialized parts: Tesla uses unique parts that are not only expensive but hard to find. This means insurers have to consider these replacement costs when determining premiums.

2. Advanced Technology and Safety Features

Tesla’s autopilot and other self-driving features are a huge draw for owners, but they can increase insurance premiums. Why? Because when something goes wrong with these systems, the liability or repair costs can be significant. Whether it’s an accident due to autopilot malfunction or a glitch in the advanced safety features, insurers account for the risk involved in these high-tech components.

Additionally, Tesla owners often assume that these safety features might help reduce premiums. But in reality, the repair costs for fixing high-tech components often offset any savings from the car’s safety ratings.

3. Theft and Vandalism Risks

Tesla cars are often targets for theft and vandalism. Their high tech parts and luxury appeal make them attractive targets, especially in certain areas where they are in high demand. In fact, Tesla models are reported to have higher theft rates than other cars. This drives up insurance premiums to cover the additional risk of theft or vandalism claims.

If your Tesla is parked in a high risk area, you may face even higher premiums. Insurers factor this in when calculating your premium, which can be another unexpected expense.

4. Limited Repair Network and Longer Repair Times

There are only a limited number of Tesla certified repair centers. These facilities tend to be more expensive than regular auto repair shops, and they often require longer repair times due to the specialized nature of Tesla vehicles. Insurance companies have to factor in the costs of these repairs, which ultimately raises the premium.

In contrast, regular vehicles can be repaired by a wide network of repair shops, which helps keep costs lower and more predictable.

5. Statistical Rarity and Data Scarcity

Since Tesla is a relatively new company, there is still a lack of comprehensive historical data regarding the long-term reliability and repair costs of their cars. Traditional insurance models rely heavily on historical data to predict future risks and set prices. Because Tesla lacks the long-term data that other car manufacturers have, insurers charge higher premiums to hedge against potential risks.

As Tesla’s fleet of cars grows, insurers may adjust their pricing models, but for now, this data scarcity continues to make Tesla insurance more expensive.

Misconceptions Tesla Owners Often Believe

There are several misconceptions that can trap Tesla owners into overpaying for insurance. Let’s criticize some of the most common and misleading beliefs:

Myth 1: Tesla Owners Always Pay More Because It’s a Luxury Vehicle

Truth:

Tesla is often classified as a luxury car, and while luxury vehicles do tend to have higher insurance premiums, Tesla’s higher premiums are primarily driven by repair costs and technological complexity, not just the brand’s luxury status. Many luxury car insurers offer competitive rates, and Tesla’s tech complexity plays a bigger role in driving up premiums.

Myth 2: Electric Cars Should Benefit from Lower Rates

Truth:

Electric vehicles (EVs), in general, may benefit from certain environmental discounts, but Tesla’s higher repair and technology costs often offset these discounts. This makes Tesla insurance more expensive than other electric vehicles.

Myth 3: Teslas Are Safer, So Insurance Should Be Cheaper

Truth:

While Tesla boasts high safety ratings, which may help reduce premiums in some cases, repair costs and technological components like the battery pack and autopilot system drive the insurance prices up significantly. The cost of repairing these specialized parts outweighs the savings from Tesla’s safety features.

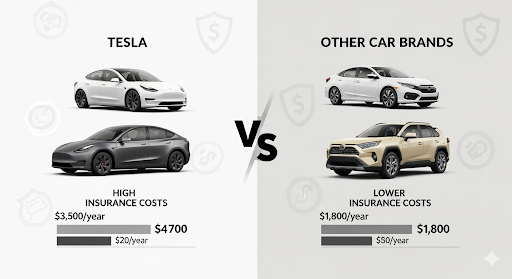

How Tesla Insurance Costs Compare to Other Cars: A Critical Snapshot

Let’s critically compare Tesla insurance costs to those of other vehicles to understand just how much more expensive it can be:

| Vehicle Type | Average Annual Insurance Cost | Key Reasons |

|---|---|---|

| Tesla Model 3 | $2,000 – $2,500 | Repair tech, battery cost |

| Comparable Luxury Car | $1,500 – $2,000 | Luxury features, but lower tech complexity |

| Mid-Range Gas Car | $1,000 – $1,500 | Cheaper parts, wider service network |

| Other EVs | $1,500 – $2,000 | Battery costs but fewer tech repairs |

As you can see, Tesla insurance can be 25-50% more expensive than comparable vehicles in similar price classes. The premium is driven by higher repair costs, advanced technology, and higher theft risks, among other factors.

How to Avoid Overpaying Tesla Insurance

While Tesla insurance is inherently more expensive than that for most other cars, there are ways to reduce your premiums without sacrificing coverage. Here’s how you can save on Tesla insurance:

1. Shop Across Multiple Companies

Don’t settle for the first quote you receive. Get quotes from traditional insurers, Tesla’s own insurance, and EV-specialized providers. This way, you can compare premiums and coverage options to find the best deal.

2. Bundle Insurance Policies

If you have homeowners, renters, or other vehicle insurance, consider bundling these with your Tesla insurance. Bundling can cut premiums dramatically.

3. Ask About Tesla Specific Discounts

Tesla-specific discounts exist, such as discounts for autopilot usage, garage parking, low mileage, and electric vehicle ownership. Make sure you ask about these to ensure you’re getting the best rates.

4. Maintain a Clean Driving Record & Use Usage Based Programs

Having a clean driving record helps you qualify for lower premiums. Some insurers also offer usage based insurance programs, where you can get discounts based on your driving habits.

5. Consider Deductible Adjustments

Raising your deductible can lower your premiums, but make sure the new deductible level is something you’re comfortable with if you need to make a claim. Find a balance that works for your financial situation.

Red Flags Indicating You Are Overpaying

Here are warning signs that you might be overpaying for Tesla insurance:

- Steep premium hikes without any accidents or tickets.

- Ignored Tesla or EV specific discounts that could lower your rates.

- Limited quotes from only a few insurers, meaning you might be missing out on better options.

- Agents refusing to discuss coverage details or discounts.

- Poor claims communication history or negative feedback about the insurer’s service.

Conclusion: Why Tesla Insurance Costs More And What You Can Do

Tesla insurance costs more than for other cars for a variety of complex reasons repair costs, advanced technology, and data scarcity, to name a few. But understanding these factors helps you take control of your premiums.

To lower your Tesla insurance costs:

- Shop around and get quotes from multiple insurers.

- Bundle your policies to unlock discounts.

- Ask about Tesla specific discounts and usage based programs.

- Maintain a clean driving record and adjust your deductibles.