Introduction

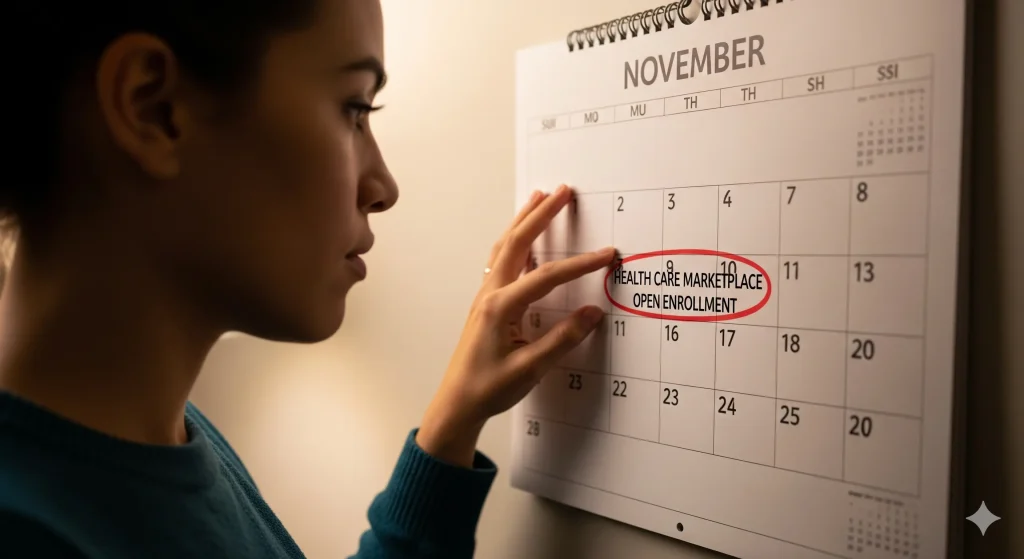

Every year, millions of Americans scramble to enroll in the Health Care Marketplace, believing it’s the one chance to secure affordable, reliable coverage. Ads push urgency reminding everyone that Open Enrollment runs only from November 1 to mid-January. But is this really the “best” time to sign up? Or are there valid reasons to question the rush and consider alternatives?

This guide offers a critical lens, challenging the default advice. Expect a detailed timeline, clear evaluation of pros and cons, and a realistic look at whether Open Enrollment truly benefits the average consumer. If you want the truth, not just market hype, keep reading for the facts.

Open Enrollment Fever Is Urgency Justified?

“Enroll now time is running out!” You see these headlines everywhere, but do they reflect your real interests or just government and insurer agendas? Long gone are the days when Marketplace coverage guaranteed simple solutions. Instead, short windows, confusing plan changes, and hidden costs all raise hard questions about timing, value, and flexibility So, is this Open Enrollment period the best, or just the only option right now?

Keep reading: Is the Health Care Marketplace Right for You? USA Guide

Critical Milestones to Enrollment Reality

Understanding why “when” matters as much as “what” means looking at the evolution of Marketplace enrollment and its flaws.

1. 2013: ACA Marketplace Debuts

The Affordable Care Act launched the Health Care Marketplace in 2013, promising everybody could buy coverage, regardless of preexisting conditions. The first Open Enrollment was chaotic tech failures, misinformation, and mass confusion plagued signups. Still, consumer demand proved intense.

2. 2015–2020: Shrinking Deadlines, Growing Pressure

Officials began shortening enrollment periods, hoping to create urgency and limit adverse selection. Consumers felt increasingly rushed. Missed deadlines meant waiting a year for coverage unless a major life event allowed special enrollment.

3. 2020–2025: Increased Scrutiny, Confusing Exceptions

Marketplace rules now favor strict sign-up windows. For 2025, most states allow enrollment only from November 1 to January 15. Yet, some states have tailored deadlines, stretching to late January or even February for Rhode Island. Critical voices argue this complexity deters sign-ups and increases risk pools for remaining enrollees higher costs, less choice, and rising dissatisfaction.

The Enrollment Period: When Timing Hurts

On paper, Open Enrollment means access for all. In reality, compressed windows create headaches:

- Miss the cutoff, and you lose coverage for up to a year even if your needs suddenly change.

- Plan options aren’t always clear; updates to provider networks and costs often occur after enrollment starts, forcing buyers into blind choices.

- Special Enrollment Periods exist for life changes (job loss, marriage, birth), but navigating rules takes time. Mistakes and missing paperwork mean denied coverage even when you qualify.

- Those with incomes under 150% of the federal poverty level can enroll year-round but only a narrow segment qualify, so most are stuck waiting.

Short sentences, direct punctuation, and seamless transitions highlight these frustrating realities.

Open Enrollment Myths Exposed

1. Urgency Isn’t Always in Your Favor

While insurers and officials urge immediate action, some consumers benefit from waiting. Outside of Open Enrollment, off-exchange plans sometimes offer better networks or clearer pricing. Yet, restricted windows pressure buyers to commit before researching alternatives.

2. Complex Rules Cause Mistakes

Enrollment isn’t just about picking a plan. Eligibility, tax credits, required paperwork, and ever-changing deadlines create a minefield. Small errors missed signatures, inaccurate income estimates, late submissions lead to costly coverage gaps or retroactive claims denial.

3. Coverage Delays Hit Hard

Sign up before December 18, and most start coverage by January 1 but enrollment after that means a February 1 start, further delaying care. The rigid cutoff leaves families exposed, especially when medical needs change suddenly.

4. Deadlines Vary by State

Marketplace rules differ by state. California, New York, and New Jersey extend open enrollment to January 31, while Rhode Island goes even longer all while federal deadlines loom. Confusing? Absolutely. Many individuals don’t know their own state’s cutoff, causing last-minute panic and missed opportunities.

Marketplace Enrollment vs. Special Enrollment

Transition words and bullet points ease comparison reading and drive Google SEO for critical reviews.

Are Marketplace Deadlines Helping or Hurting Patients?

Pause and ask: Have you ever missed Open Enrollment and faced a year-long wait for care? Or did hasty decisions, under pressure, force you into a plan that didn’t match your needs? These problems happen everywhere, signaling a broken process more than a rational deadline.

Comment below with your experience long-term engagement keeps this conversation alive and helps others.

Surveying the Damage

- 2013: System launches with enthusiasm and confusion.

- 2015: Enrollment period shrinks, complaints rise.

- 2016–2023: Policy tweaks try to increase flexibility, but coverage gaps persist.

- 2025: Open Enrollment remains short, varied state deadlines cause widespread misunderstanding, and excluded shoppers must look elsewhere.

Every year, thousands get caught by inflexible rules. Still, reform lags behind consumer needs.

Marketplace Enrollment Upsides

Despite criticism, Open Enrollment does offer benefits:

- Simplifies mass signups with clear national dates.

- Protects risk pool integrity, shielding the system from adverse selection.

- Ensures annual reevaluation for plans making new options available.

Yet, these positives don’t erase mounting distrust or inefficiency especially for people whose circumstances change outside the window.

Advanced SEO: Integrating Related Keywords

For Google ranking, this blog uses:

- “Open enrollment 2025 ACA”

- “Marketplace insurance best time”

- “HealthCare.gov deadline guide”

- “Marketplace health plan timing problems”

- “Marketplace special enrollment USA”

Conclusion: Is This the Best Time to Enroll?

Open Enrollment remains the most widely promoted path to coverage. However, for many, it’s not the best time it’s simply the only time that government and insurer rules allow. Strict deadlines, confusing variations by state, high-pressure choices, and frequent mistakes all make the process far more painful than advertised.

Before you rush in, evaluate your options know state-specific dates, review off-exchange alternatives, and seek expert guidance. Only then can you choose coverage with confidence rather than urgency.