Introduction: The Hidden Hassle of Switching Tesla Insurance Providers

Owning a Tesla comes with many perks advanced technology, eco-friendly driving, and cutting-edge design. However, it also comes with an unexpected frustration: Tesla insurance. For many owners, dealing with high premiums, complex coverage, and occasional service issues is part of the experience.

The real challenge? Switching insurance providers.

Many Tesla owners assume that switching their insurance provider will be filled with paperwork, cancellation fees, coverage gaps, and complicated logistics. This creates fear and hesitation, leading them to stay with their current provider often paying much more than necessary.

In this blog, we’ll dive into the myths and realities that prevent many owners from switching Tesla insurance providers easily. You’ll also learn how to make this process seamless, smart, and financially rewarding. Get ready to uncover the truth behind Tesla insurance switching and take control of your premiums and coverage.

Timeline: How Most Tesla Owners Botch Their Insurance Switch

Let’s take a look at a typical timeline that shows how Tesla owners often end up overpaying or getting stuck with poor coverage:

- Frustration Sets In:

You realize your Tesla insurance rates are higher than expected or your service provider isn’t as responsive as it should be. - Comparison Paralysis:

You begin to shop for alternatives, but quotes, terms, and policies overwhelm you. With so many options and variables, it’s easy to feel lost. - Fear of Switching:

The idea of dealing with cancellation penalties, gaps in coverage, or losing discounts paralyzes you. You worry that switching might cause more harm than good. - Delayed Action:

As months pass, you stick with your current provider overpaying without really considering better alternatives. - Last-Minute Rush:

When your renewal notice comes around or the frustration becomes unbearable, you scramble to find a new insurer often making rushed decisions that lead to overlapping coverage or unexpected fees. - Loss of Benefits:

In some cases, the switching process is rushed, resulting in lapsed coverage, unexpected fees, or loss of previously earned discounts.

Why Switching Tesla Insurance Providers Seems So Difficult

Tesla owners face unique challenges when switching their insurance providers. Here’s why the process is often trickier compared to conventional vehicles:

- Specialized Coverage:

Tesla’s advanced technology, like autopilot and self-driving capabilities, requires specific policy terms. Additionally, battery repairs and specialized repairs come with high costs that must be covered adequately. - State-Specific Rules:

Each state has different laws regarding insurance cancellation, new policy activation, and the minimum required coverage. Some states impose longer notice periods or penalties for early cancellation. - Existing Contract Penalties:

Some insurers impose cancellation fees if you try to switch before a certain term ends, which is often a surprise to many owners who think they can just cancel without consequences.

Understanding these complexities helps prevent unnecessary stress and enables you to make a switch more efficiently, ensuring continuous coverage without losing money.

Common Myths That Trap Tesla Owners

Let’s address the common myths that prevent many Tesla owners from switching their insurance providers:

Myth 1: Switching Means Coverage Gaps Are Inevitable

Truth: With proper timing and coordination, your new policy can start as soon as the old one ends. You can avoid coverage gaps by making sure the start and end dates of the two policies are aligned.

Myth 2: Insurance Agents Won’t Help Switch Providers

Truth: Many insurance agents and brokers actually help facilitate switching for free or at low cost. They have a vested interest in your satisfaction, and facilitating an easy switch is a great way to earn your trust and loyalty. Don’t hesitate to ask for their help.

Myth 3: Cancellation Fees Are Always High

Truth: Many insurers waive cancellation fees if the policy has been active for a minimum term. Some may even offer pro-rated refunds, so you don’t end up paying more than you should.

Myth 4: The Cheapest New Provider Is Always Worse Quality

Truth: Affordable insurance providers can still offer excellent service. A lower premium doesn’t necessarily mean poorer coverage. Do your research, look at reviews, and compare not only price but also the quality of coverage.

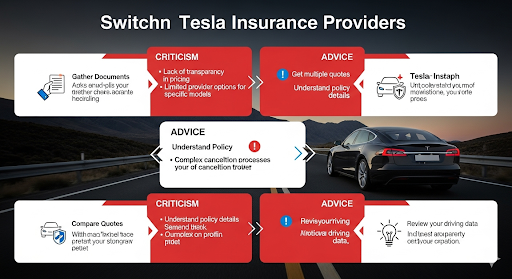

How to Switch Tesla Insurance Providers Easily: Step By Step Criticism & Advice

Switching Tesla insurance doesn’t have to be a headache if you follow the right steps. Here’s a breakdown of how you can successfully switch providers while avoiding common mistakes:

Step 1: Don’t Rush Understand Your Current Policy

Before you switch, carefully review your existing policy for the following:

- Cancellation terms and fees

- Renewal date and any auto renewal clauses

- Coverage specifics to make sure the new policy will match or improve on what you currently have.

Don’t rush to cancel your old insurance. Understand your policy’s terms so you don’t run into hidden fees or penalties that could surprise you later.

Step 2: Always Have Your Next Policy Secured First

Never cancel your Tesla insurance before securing your new policy. Make sure that your new insurance policy is active before canceling your old one. Overlap the coverage dates slightly to avoid gaps that leave you exposed.

A gap in coverage can cause problems, especially if you have a lease or loan agreement for your Tesla.

Step 3: Use Comparison Tools but Read Beyond Premiums

When comparing Tesla insurance providers, don’t just look at price. Focus on:

- Coverage limits

- Discounts offered (e.g., Tesla-specific discounts)

- Claims reputation and customer service

Be cautious of lowball quotes that sound too good to be true. They may exclude important coverage or have hidden fees that make them less affordable in the long run.

Step 4: Notify Your Current Provider in Writing

Once your new policy is confirmed and active, inform your current insurer of your cancellation date in writing. This ensures that you have proof of your cancellation request. Always keep a record of this communication (emails, letters) in case of disputes.

Step 5: Coordinate Payment and Policy Documents

Before the switch date, ensure that your new policy documentation is complete, and your payment has been processed. Double-check that your Tesla is listed accurately, and make sure the policy limits meet your needs. This helps ensure there are no issues once the switch is made.

Step 6: Confirm Complete Cancellation

A few days after the cancellation date, follow up with your old provider to verify that your account is closed and no further charges are applied. This prevents billing disputes or accidental charges.

Side by Side Comparison: Common Switching Challenges and Solutions

| Challenge | Why It Happens | How to Solve It |

|---|---|---|

| Coverage gaps | Canceling old before starting new policy | Coordinate start/end dates precisely |

| Unexpected cancellation fees | Early termination penalties | Check policy terms beforehand |

| Lost discounts or rewards | Not transferring loyalty benefits | Ask if new provider matches benefits |

| Confusing policy terms | Complex Tesla-specific coverage | Use an independent agent or broker |

| Administrative delays | Paperwork backlog or errors | Submit cancellations in writing and confirm |

Red Flags That Make Switching Harder Than It Should Be

When shopping for a new Tesla insurance provider, watch out for these red flags that could make your switching experience harder than it needs to be:

- Long mandatory contract periods with steep penalties for early termination.

- No clear cancellation or refund policy detailed upfront.

- Poor communication or unresponsive customer service.

- Policies that don’t explicitly cover Tesla’s unique technology.

- Lack of documented proof for cancellation requests.

These are signs of an insurance provider that may cause more headaches than benefits. Avoid them at all costs.

Why Tesla Owners Often Delay Switching To Their Detriment

Many Tesla owners put off switching insurance providers due to fear and confusion. The common narrative is that switching is a hassle, and that sticking with the current provider is just easier. Unfortunately, this passive behavior costs money in the long run:

- Costing money monthly: Sticking with an overpriced policy means losing money month after month.

- Reduced bargaining power: Over time, you lose leverage when you accept rate hikes without questioning them.

- Decreased chances of finding better coverage: You’re not exploring alternatives, so you may miss out on policies with better service or lower premiums.

Conclusion: Switch Tesla Insurance Providers Easily with the Right Approach

Switching Tesla insurance doesn’t need to be as complicated or costly as many owners believe. To make a smooth, easy transition, here’s what you need to do:

- Understand your current policy and avoid blind cancellations.

- Secure new coverage before cancelling the old.

- Compare Tesla insurance providers thoroughly not just by price but by coverage, customer service, and discounts.

- Communicate clearly with both your old and new insurers, keeping proper documentation of all interactions.