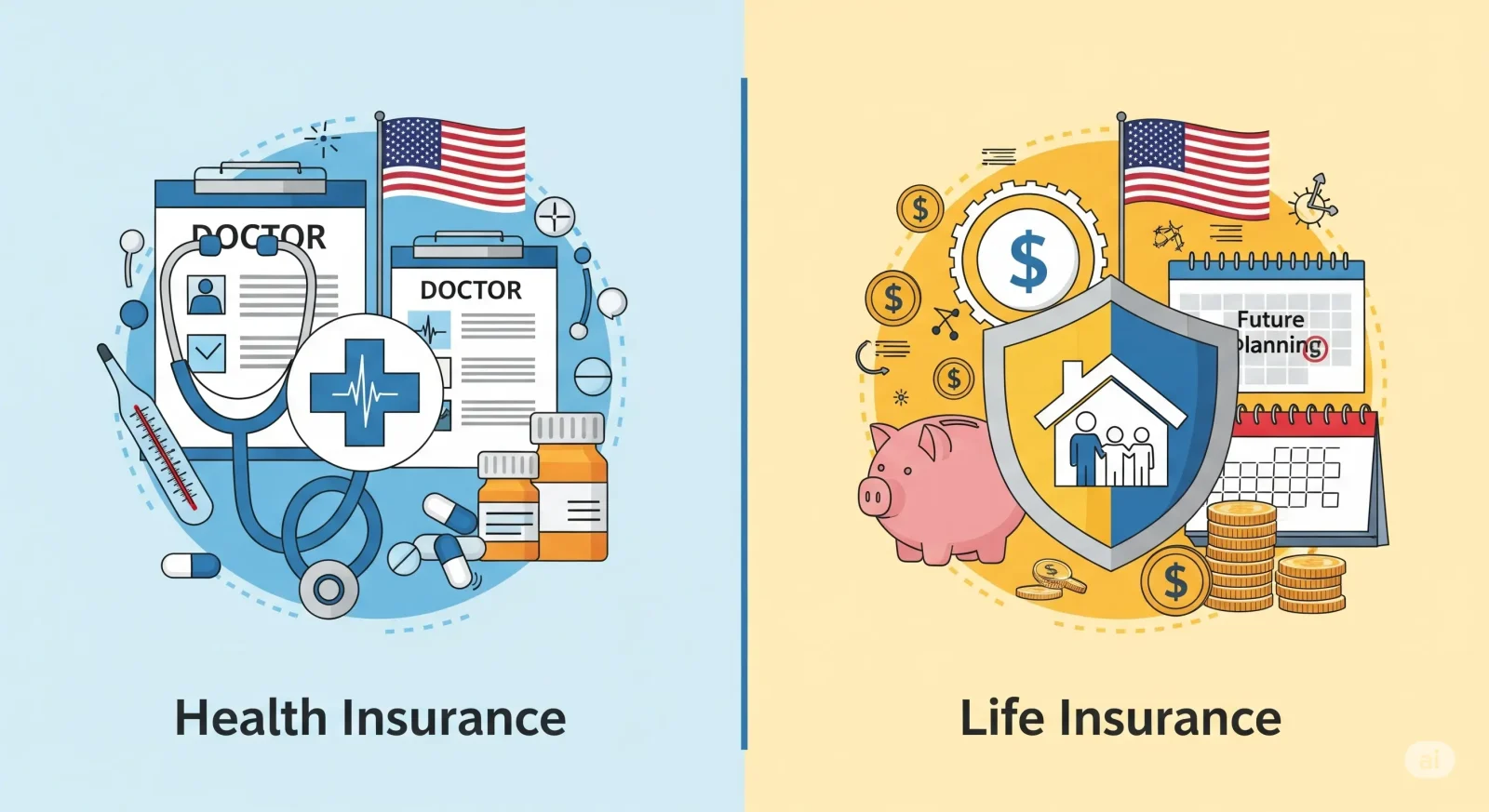

Introduction: Understanding The Real Differences Between Health and Life Insurance

When it comes to protecting yourself and your loved ones, insurance is often top of mind for many Americans. Especially in the US, the conversation usually revolves around two major types: health insurance and life insurance. But despite their prominence, these two serve fundamentally different purposes and many people, especially first time buyers or younger adults, struggle to grasp what each really does.

Searching for “health vs life insurance” is common, with consumers trying to figure out which one fits their needs better, or if they need both. The reality? While health insurance covers you during your lifetime helping with medical bills, doctor visits, hospital stays life insurance provides financial security to your beneficiaries after you pass away.

Which should take precedence? How much coverage is enough? What are the hidden traps behind these policies? Unfortunately, many people make costly mistakes because they don’t understand the nuances or get swept up in sales pitches.

This guide unpacks the key differences between health insurance and life insurance for US consumers in 2025. We’ll examine what’s genuinely important, where misunderstandings lurk and how to make smarter, well informed choices.

Why This Choice Is So Important

Choosing between health and life insurance isn’t mere semantics or marketing speak. It’s about how you allocate scarce dollars to protect yourself and your family in meaningful ways.

Do you divert funds to cover urgent medical costs or to safeguard your family’s future? Your age, health, family situation and financial goals all play a big role in this decision.

Understanding these distinctions helps ensure you don’t just buy a policy because a slick ad told you to, but build a coverage plan that truly suits your life.

What Is Health Insurance and Why Do You Need It?

Health insurance is a contract that covers some or all of your medical expenses. It protects you from the staggering costs of doctor visits, hospital stays, surgeries, medications, and preventive care.

Key features include:

- Coverage Scope: Doctors, hospitals, prescriptions, emergency services, preventive screenings, mental health care.

- Payment Structure: Premiums paid monthly, plus deductibles (amount you pay before insurance kicks in), co-pays (fixed fees for visits or meds) and coinsurance (a percentage of costs).

- Provider Networks: Many plans restrict coverage to a network of doctors and hospitals; out of network care can cost a lot more.

- Plan Types: Employer based, private Marketplace (Obamacare) plans, Medicaid for low income, Medicare for seniors, and short term solutions.

Why Health Insurance Is A Must Have

Healthcare bills in the US can easily bankrupt individuals and families if you’re uninsured. Even a simple emergency room visit without insurance can cost thousands of dollars. Health insurance doesn’t just protect your pocketbook it allows you to seek timely and quality care.

What Is Life Insurance and Why Does It Matter?

Life insurance is very different. It’s a policy paid out to your beneficiaries when you die, offering them financial support.

Types you’ll commonly encounter:

- Term Life: Coverage for a fixed period (e.g., 10, 20 or 30 years). Typically affordable and straightforward.

- Whole Life: Permanent coverage that also builds cash value over time but at higher cost.

- Universal/Variable Life: Flexible policies with investment options but more complexity and risk.

Who Should Prioritize Life Insurance?

Life insurance is critical if:

- You have dependents relying on your income.

- You have debts like mortgages or student loans.

- You need to ensure funeral and final expenses are covered.

- You’re a business owner seeking buy-sell agreements or protecting business continuity.

Even if you’re young, locking in affordable life insurance premiums early often pays off.

Comparing Health and Life Insurance: Side By Side

| Aspect | Health Insurance | Life Insurance |

|---|---|---|

| Purpose | Covers medical costs during your lifetime | Pays beneficiaries a set sum after your death |

| Main Benefit | Pays for doctor visits, hospital stays, prescriptions | Provides income replacement, pays off debts, covers expenses |

| Cost Factors | Premiums + deductibles + co-pays/coinsurance | Premiums based on age, health, policy type, and coverage |

| Duration | Active only while policy is valid | Can be term limited or last throughout lifetime |

| Complexity | Moderate involves networks, coverage rules | Can be complex involves riders, cash value, investment options |

| When To Use | Protects from medical financial ruin | Protects family financially after your passing |

Hidden Pitfalls to Watch Out For

Insurance isn’t as simple as commercials make it look potential traps abound:

Health Insurance Challenges

- Network Confusion: Not every doctor accepts your plan; out-of-network care can be shockingly expensive.

- Unexpected Bills: Deductibles and coinsurance might mean you pay thousands despite having insurance.

- Treatment Exclusions: Some plans exclude specific procedures like fertility or cosmetic surgeries.

- Complicated Terms: Insurance jargon can confuse even savvy consumers.

Life Insurance Dangers

- Underinsured Risks: Many buy insufficient coverage, which leaves their family vulnerable.

- Policy Complexity: Riders and investment options can confuse buyers into costly, unsuitable products.

- Rising Premiums: Whole and universal life policies may become difficult to maintain financially.

- Medical Exams: Health issues can increase premiums or lead to policy denial.

When Should You Prioritize Health Insurance?

Generally, health insurance is the foundational coverage everyone needs especially in the US’s complicated and costly healthcare system.

Young and healthy? Marketplace options keep costs low while offering essential coverage.

Starting a family? Comprehensive coverage for pediatric and maternity care is critical.

Suffering chronic illness? Robust insurance for ongoing meds and specialist visits is vital.

Missing health insurance isn’t a risk anyone should take financially.

When Does Life Insurance Become Essential?

As your fears shift from “what if I get sick?” to “what if I don’t come back,” life insurance grows in importance.

Young parents, homeowners with mortgages, business owners, or anyone with financial dependents must seriously consider life insurance.

Getting covered earlier locks in lower premiums and peace of mind.

The Power of Combining Both

Most savvy consumers blend health and life insurance as complementary protections health insurance for your living medical costs, life insurance for your family’s financial security when you’re gone.

Start with affordable health coverage.

Add life insurance as your financial responsibility grows.

Review and tweak both regularly.

A Timeline for Insurance Priorities

- Early 20s: Prioritize health insurance; consider term life if you have dependents.

- Late 20s, 30s: Boost coverage, especially life insurance with family expansion.

- 40s+ years: Shift toward permanent life insurance, upgrade health plans as needed.

- Retirement: Transition to Medicare; adjust life coverage per estate plans.

Tips for Choosing Wisely

- Assess your personal and family needs carefully.

- Don’t buy one-size-fits-all solutions.

- Shop around and compare policies.

- Avoid aggressive sales and understand fine print.

- Regularly revisit and update coverage as life changes.

Conclusion

Both health and life insurance are crucial, but they serve different purposes.Health insurance protects you today, shielding from devastating medical costs.Life insurance protects your loved ones tomorrow, ensuring their financial security.Understanding their distinct roles empowers smarter coverage decisions for US consumers in 2025.Don’t get distracted by buzzwords; focus on building a strategy that truly safeguards your present and secures your future.

Leave a comment